The Tata acquisition of Air India and the proposal to merge with Vistara (a JV between Tata Sons and Singapore Airlines) has heated up the already interesting Indian aviation industry.

Here’s my simple take on the proposed Air India and Vistara merger which I have broken down into domestic and international markets. The latter being more interesting.

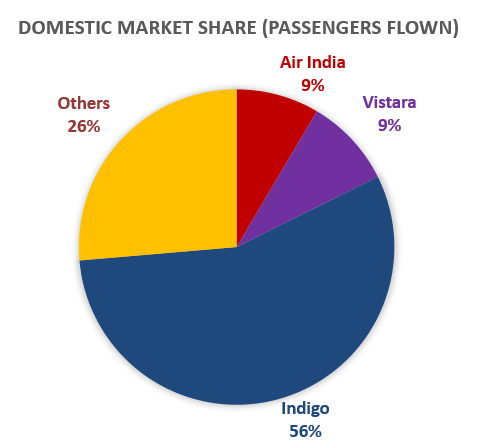

Domestic

Lets look at the market share of airlines

Data period: January – August 2020.

Well, it is quite clear, Indigo would still be the largest airline by quite some distance even after a merger. A few critical questions come to my mind –

- How will Air India and Vistara coexist? – Both compete on the same routes and have a Full Service (FS) offering

- Will the Vistara brand be done away with? I don’t think this will happen as Vistara has good reputation in India and was recently ranked the 20th best airline in the world

- The Low Cost Carrier (LCC) dilemma – India loves Indigo. Will Tata float an LCC+ (low cost but slightly better) offering to grab some market share? Introduce domestic flights on Air India Express which is an LCC?

Tata will capture the entire FS domestic market in India. However, if they have bigger ambitions, I sense a LCC or LCC+ offering is needed.

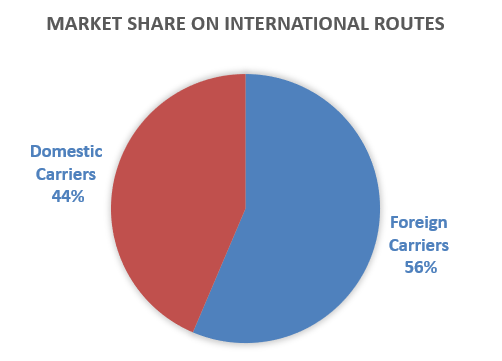

International

The Tata super airline not only has the potential to become India’s leading carrier for international travel, but perhaps can also challenge the hegemony of the middle east carriers.

Lets understand the market better:

Foreign carriers have a larger share of the international traffic to and from India

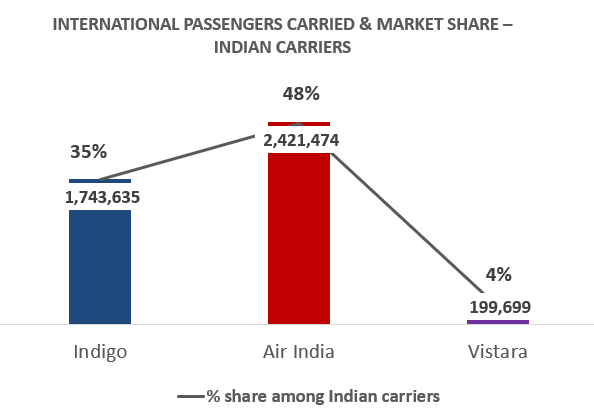

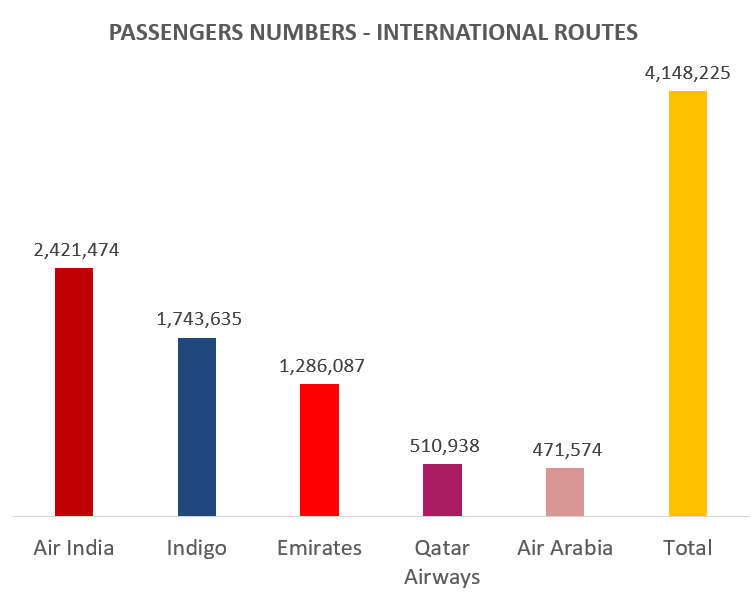

Air India (includes Air India and Air India Express) is the largest Indian carrier on international routes

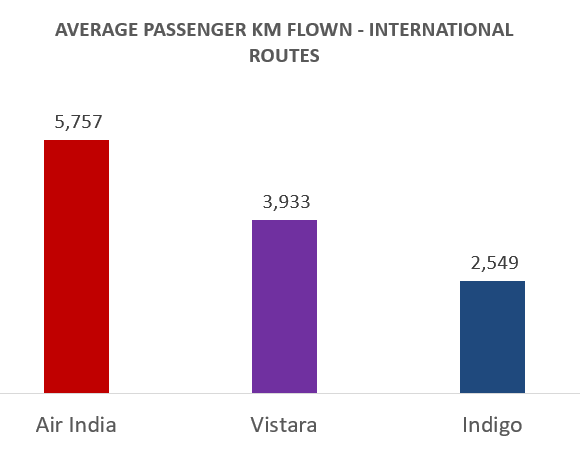

Air India operates long, medium, and short haul routes; Vistara has short and medium haul routes, and Indigo focuses exclusively on short haul routes,

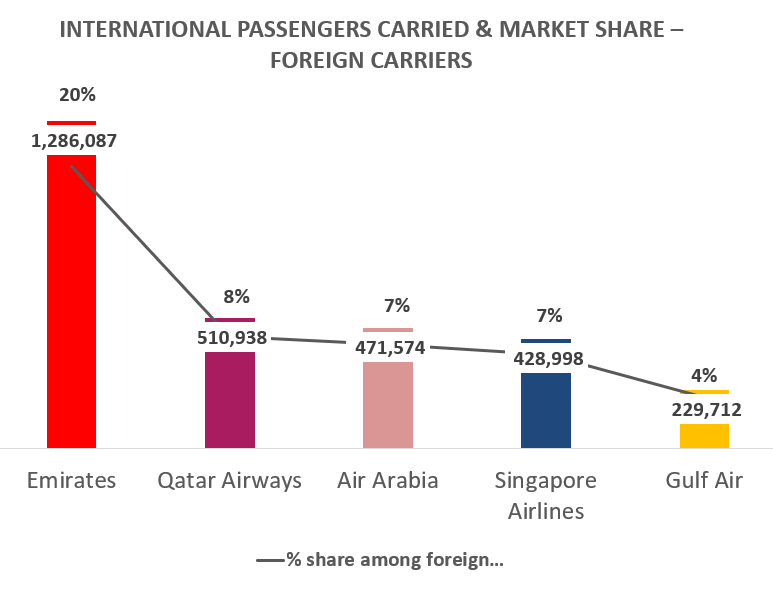

A total of 70 foreign carriers operate on Indian international routes, out of which 5 hold a 46% market share. Notice 39% is by middle east carriers.

Ranking the largest airlines on India’s international routes. The middle east carriers ferry 20% of the entire traffic.

Data period: April – June 2022

Air India includes Air India and Air India Express

__________________________________________________________

As we can see, 2.27 million or about 20% of all passengers are ferried by 3 foreign carriers. What’s more interesting is that all these carriers are based out of the Middle East, the flying hub of the world. Goes without saying, a large % of passengers on these Middle East carriers are flying to destinations outside the M.E. This is one of the biggest markets Tata can look to capture in the coming years.

Moreover, I would say, Tata can become the carrier of the world through hub(s) at the expanding Delhi/ Bangalore airports. India’s lower cost structure and fairly advantageous location (though not as good as the M.E) might help Tata compete with Emirates, Qatar, and Etihad on Africa, Europe, and Asian routes. However, the alleged government subsidies to M.E carriers can erode any cost advantage Air India has.

While it’s good to have lofty ambitions (which I feel are achievable), Tata will have to get a lot of things right to make this happen:

- Improve the inflight experience and Air India brand which has taken a big hit over many years

- Rationalise the fleet across Air India, Air India Express, and Vistara

- A smart strategy to prevent Air India, Air India Express, and Vistara from stepping on each other’s shoes.

- Air India would be the overarching brand

- Air India Express being a short haul LCC is the ideal direct competitor for Indigo

- Vistara perhaps can be a medium haul FS carrier

- The synergies with Singapore Airlines are here to stay. I’d guess Singapore Airlines would seek some exclusivity for few routes and would be a major code share partner for some destinations, my guess is S.E Asia and Oceania. Tata effectively gets a hub (with some limitations) at Changi airport.

These are interesting times for the Indian aviation industry with the Tata acquisition of Air India and subsequent proposal to merge with Vistara, the launch of Akasa, the domination of Indigo, the revival of Jet Airways, and the tough times being faced by Spicejet and Go First.

Data source: DGCA