What do PSG and Central Banks have in common?

They see a problem. They throw money at it. Both are prolific at creating Crazy Asset Valuations (well, players are assets for a football team)

Have you found yourself asking – Why is that stock trading at a 1000 P/E? A startup became a unicorn in under 6 months. What?

Well, this recent nutty valuation frenzy reminds me of one famous football transfer back in 2017. PSG successfully completed the transfer of Neymar for a whopping $290m which inflated the football markets forever. With the newly inherited stack of cash, Barcelona bought a little-known Dembele for $180m (is he still in the hospital?) and a good but woefully overpaid Coutinho from Liverpool for a cool $185m. Liverpool on the other hand bought Virgil Van Djik for $104m, the most expensive CB of all time (He actually is pretty good). Football players continue to be sold at crazy high prices to this date. The Neymar transfer was the trigger.

The recent bizarre asset valuations in the unlisted and listed equity markets have occurred in a similar fashion. The market is flooded with cash (thanks to the monetary easing resulting from the COVID-19 pandemic). This cash has been created by Central Banks.

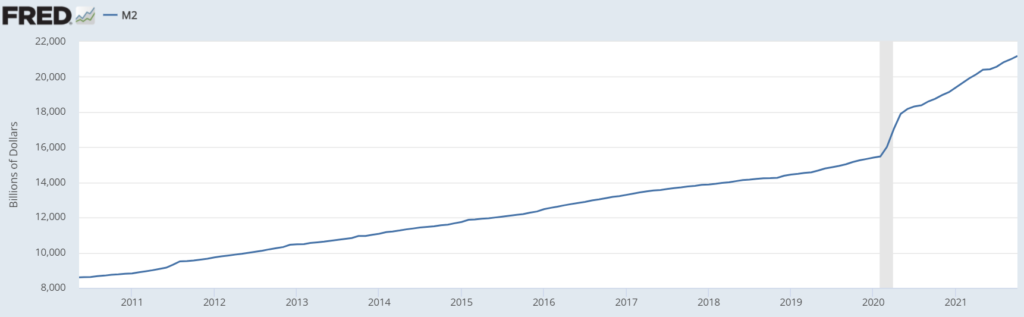

Check out this graph below showcasing M2 money supply

What is M2 Money Supply?

M1 is the total amount of cash and current account balances. M2 is M1 but with savings accounts, money market funds and other deposits included. Broadly, M2 includes money that is not completely liquid, but that can be quickly converted into cash or back into current accounts.

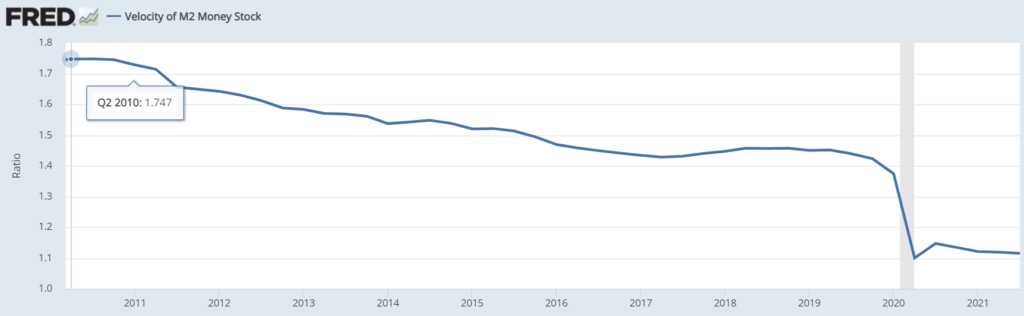

On the other hand, this newly created money is not being “spent” in the economy.

The “velocity of money”

What is the Velocity of Money?

The velocity of money is the frequency at which one unit of currency is used to purchase domestically- produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is decreasing, then fewer transactions are occurring between individuals in an economy.

What happens when there is too much money and people are not spending it?

Well, they bid up the price of assets, especially equities that offer inflation-adjusted returns. There is too much money chasing few assets! It’s basically what football clubs do when they chase the small group of elite players. Neymar in 2017 was sold for $290m, a Neymar equivalent in 2024 could very well cost $400m. No eyebrows raised.

How can this be corrected?

Monetary easing can be reduced so that the excess cash floating in the market is reabsorbed by Central banks. Alternatively, other asset classes should be able to provide risk-adjusted incomes so that equity prices are not jacked up with all cash coming their way. Continuing with the football analogy, real restrictions on the amount a club can spend may prevent the bidding up of player prices and consequent cash windfall for the selling club. A larger cohort of “top-billed” players may also reduce the bidding war for a select few.