Irrational Exuberance. Oh no, not that again! I know I will not be winning too many people over by playing the devil’s advocate in this piece.

Coined by Alan Greenspan, Irrational Exuberance can be defined as incredibly high asset prices not easily justified by fundamentals. Or as I like to put it: The phase of a market cycle where participants believe nothing can ever go wrong.

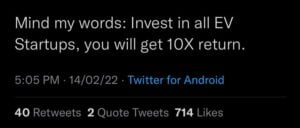

This irrational exuberance is quite easily identifiable on social media platforms and even during everyday conversations. Twitter is my favourite barometer! The sentiment around markets and investments in general has changed drastically from the nadir that was COVID-19 sell off and now my feed is cluttered with thoughts such as these:

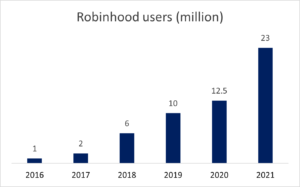

I am not surprised by this surge in sentiment, especially among first time investors. We have had a super spike in first time retail investors through easy to use platforms such as Robinhood, Zerodha, Upstox and the likes. Reddit and Elon Musk driving up prices of fundamentally poor companies like GameStop [NYSE: GME] and meme cryptocurrencies like Dogecoin are all strong indicators of the exuberance in the markets. My personal favourite- The Upstox advertisement on Indian television which deems investing in equities easier than using an escalator!

Over the last 12 months, all that was required to make a handsome return is to merely invest in the market. I daresay research was a waste of time as anything and everything went up, especially technology.

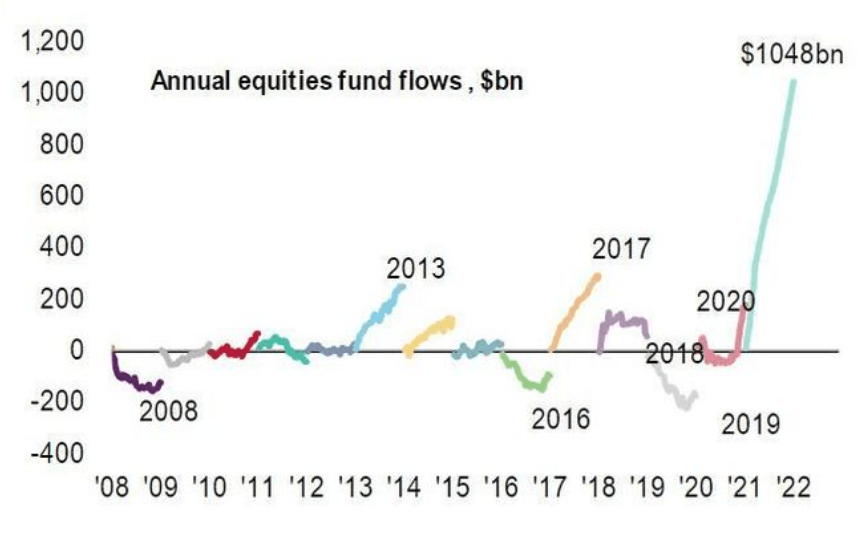

Inundation of money in the markets, record low interest rates, Covid induced low consumer spends and heightened savings, easy to use investing platforms, and social media messaging have all contributed to the super (and rather irrational) bullishness in markets.

The $1 trillion that has flowed to global stocks in 2021 is bigger than the last 20 years combined

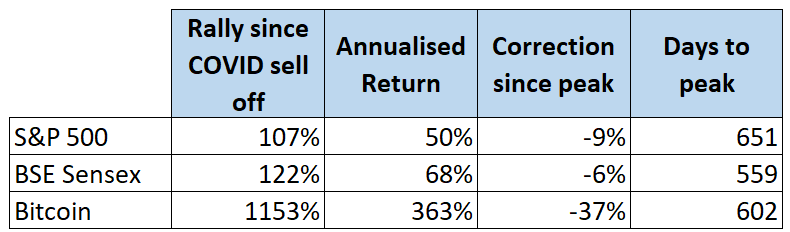

I believe the market has reached a peak and the listed markets have started correcting.

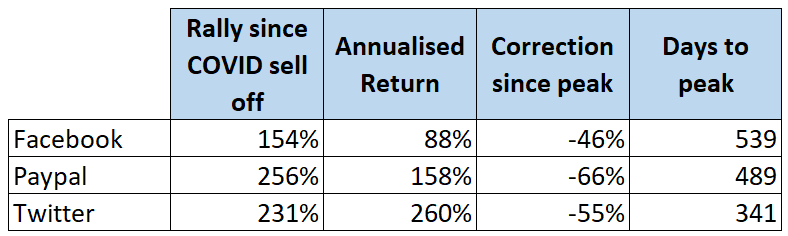

Select US Equities which have been battered over the last few weeks.

The funny bit is that the broad market and even the above stocks had buy ratings at their ATH prices!

Now coming to the Private Markets

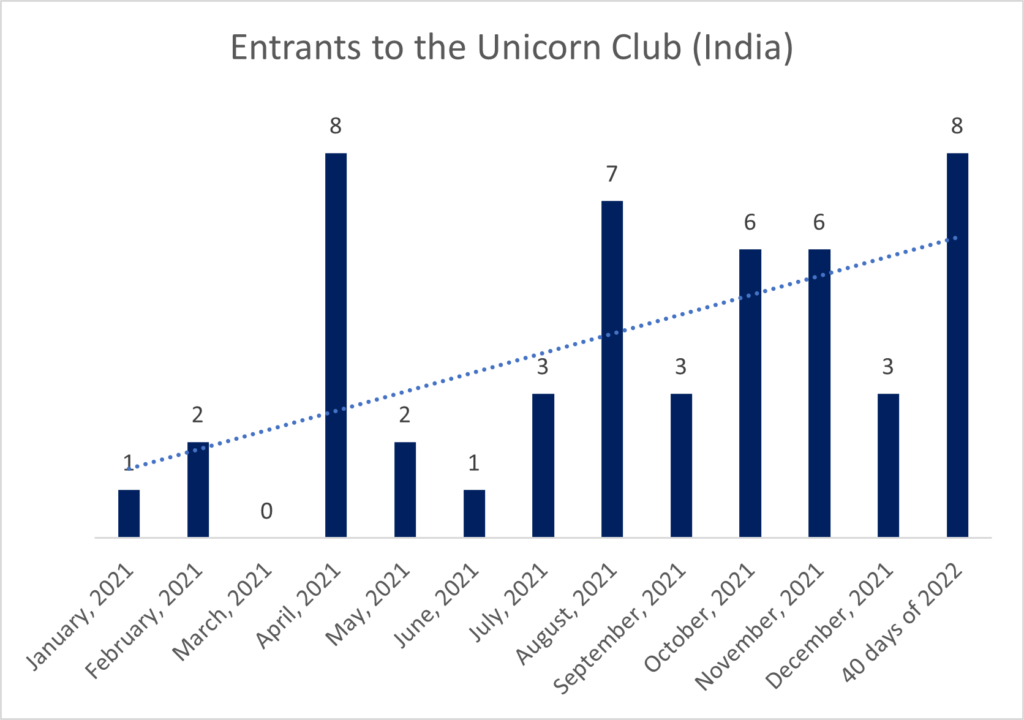

The private investments are still on an upward trajectory with no signs of slowing down. India created 8 unicorns in the first 40 days of 2022. That is a mind boggling 1 unicorn every 5 days!

Out of India’s 94 Unicorns, 50 attained the elusive $1 billion valuation in the last 13 months! One did so within 1 year of being operational.

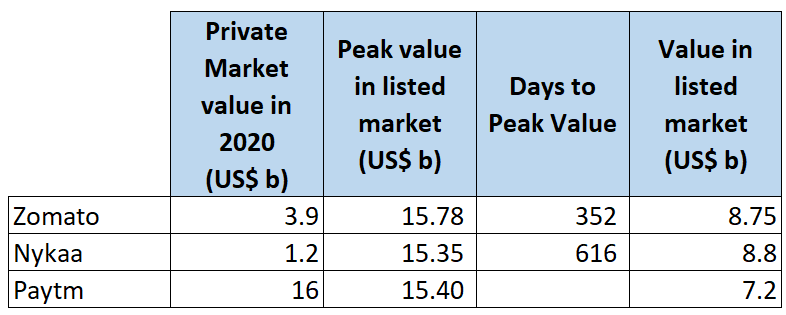

To be clear, I’m not questioning India’s entrepreneurial abilities, in fact I have never been more optimistic about it! However, I do not understand the valuations the companies are trading at.

As all other markets have started cooling off, I do not see how the private markets can hold on. Heightened private market valuations can lead to a host of problems in future. Many rely on multiple rounds of funding to continue growing (sometimes to just survive), these funds can quickly dry up if over valued startups cannot possibly justify a higher valuation for the next round.

Non profitable (or barely profitable) entities have not been valued with same fervour by public markets. Their stock price often has no real floor as these businesses are unable to provide a credible forecast on when they can turn cash flow positive.

Paytm is my favourite company of the lot, It listed with such a rich valuation that it could never take off despite the general optimism around equities.

I’ll keenly watch the private markets over the next one year. Curious to see if more sense will prevail or we continue to pump out unicorns at the present rate.

Data Sources: BofA Global Research, Marketwatch, Yahoo Finance, Inc42