Many would recall the 2008 crisis where a spike in interest rates coupled with a slowing economy led to record residential mortgage delinquencies which sparked a collapse in the entire global economy. By the way, while the USA remains resilient, other markets such as the UK might be going down the same path once again.

Drawing parallels with what happened in 2008, we look at credit card debt in the USA.

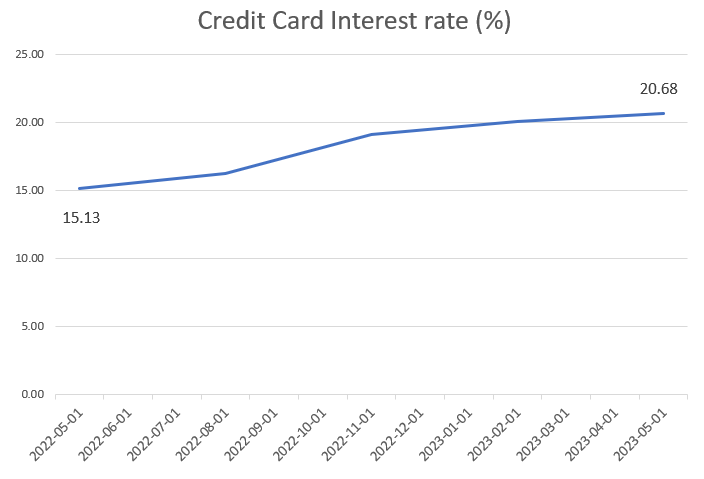

- Highest ever credit card interest rate at 20.68% with a sharp 5.5% increase in the last one year.

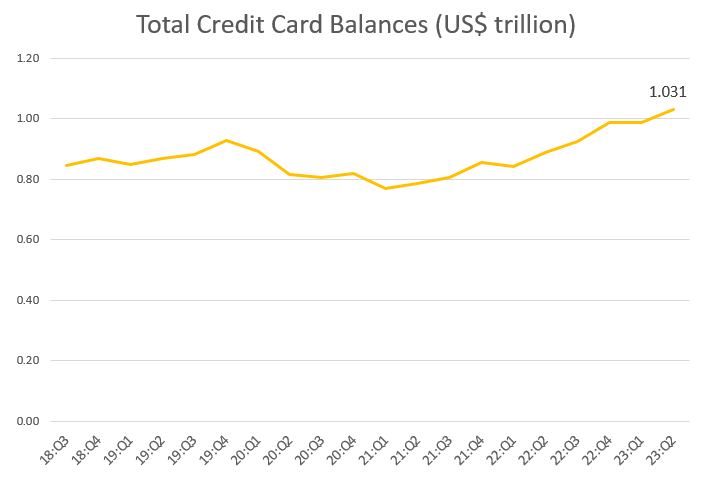

- Highest ever credit card balances at $1.03 trillion

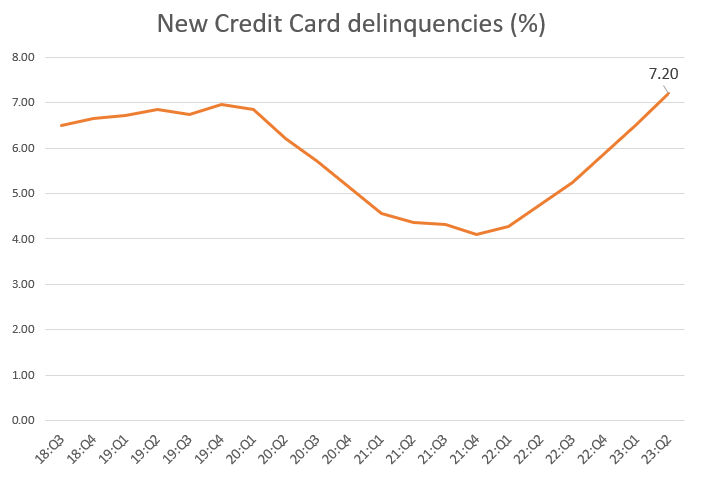

- Rising delinquencies, and

- Depleting pandemic savings

Something doesn’t feel right? Record high debt, a sharp rise in interest rates, and rising delinquencies. Quite like 2008, isn’t it?

Macy’s sounded the alarm in its last earnings release: They reported a rise in theft, a rise in credit card delinquencies, and a drop in credit card purchases which led to an unexpected drop in revenue.

The rising interest rates and delinquencies can significantly slowdown consumer spending in the coming quarters adding to the woes of slowing real estate (again triggered by high interest rates), rising delinquencies in auto loans, and the inability of businesses to borrow growth capital at the prevailing high rates.

Recession on the cards?