Well, seems like the grim predictions from my article are coming true. Startups with short runways and relying on frequent venture money may find themselves in a tough spot in the coming months as investments reduce and valuations dip.

One particular sector that has caught my eye is BNPL i.e. Buy Now Pay Later.

For the uninitiated, BNPL Companies (BNPLs) allow customers to buy a product and pay for it over a span of time. The effective loan extended to a customer can sometimes be interest free (brands pay BNPLs a share of their profit as the BNPL option incentivizes sales)

The perfect storm of high inflation, increasing rates, and elevated debt levels seems like bad news for BNPLs. So, what potential issues are on the horizon?

High inflation:

- Erodes the purchasing power of BNPL customers which increases the likelihood of them defaulting on their EMIs.

- The higher inflation may reduce the appetite for discretionary expenditure.

- BNPLs suffer a loss in income if the loan was extended at a fixed rate or at 0% interest as the value of money is falling.

Increasing rates:

- Increases the borrowing costs of BNPLs.

- Disincentives customers from buying products using BNPL as their EMIs increase.

- Present EMIs locked in by the BNPL at lower rates could incur losses

Elevated debt levels:

- Customers living above their means will not buy more products using BNPL, especially as interest rates are rising.

With the global economy slowing down and a full-blown recession expected in a quarter or two, there is greater incentive for companies to use BNPL to increase sales. However, this trick to keep sales figures high comes at the cost of taking on greater credit risk. In my humble opinion, this little game can only end in an unpleasant manner – greater defaults and the shuttering of BNPLs which have poor risk management practices in place.

Some interesting graphs

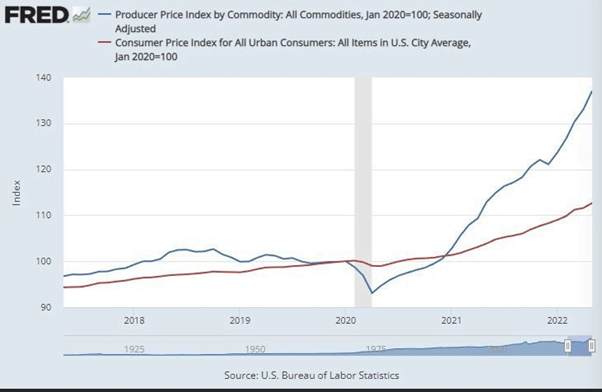

The PPI (Producer Price Index) is trending higher than the CPI (Consumer Price Index) which is an indicator of more pain to come for consumers as producers pass on their increasing costs in the form of higher prices.

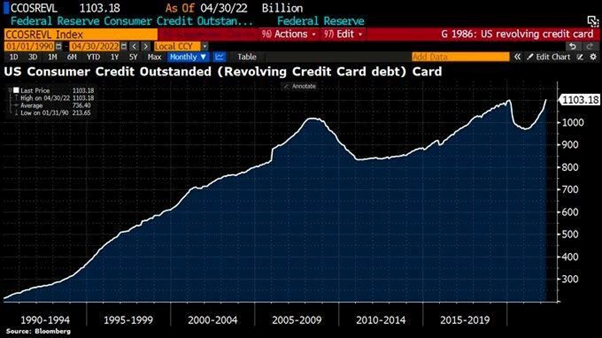

US Outstanding Credit Card Debt is at an all time high (once again) after the stimulus cheques were used to pay down the debt during the pandemic

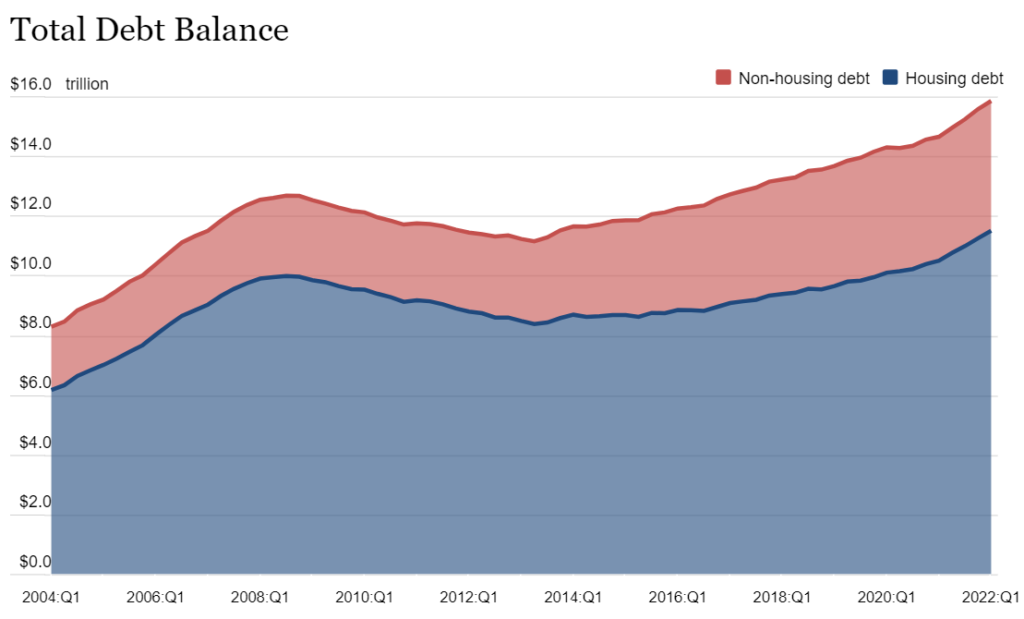

The ever increasing US Household debt!

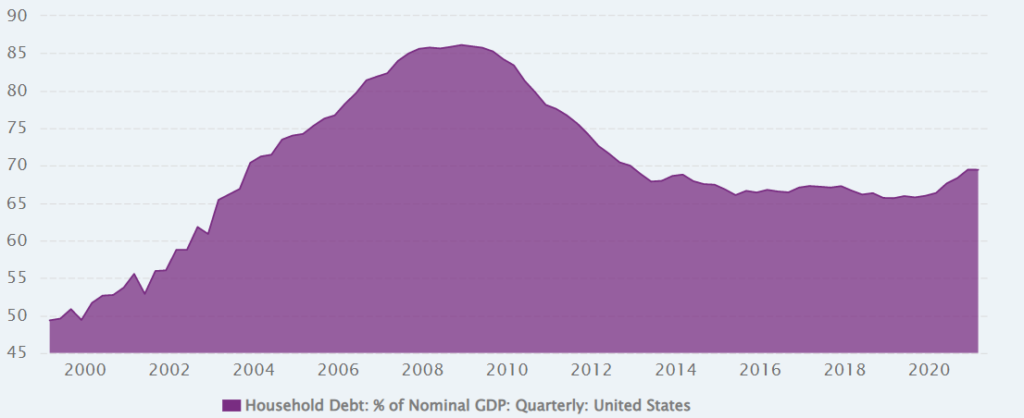

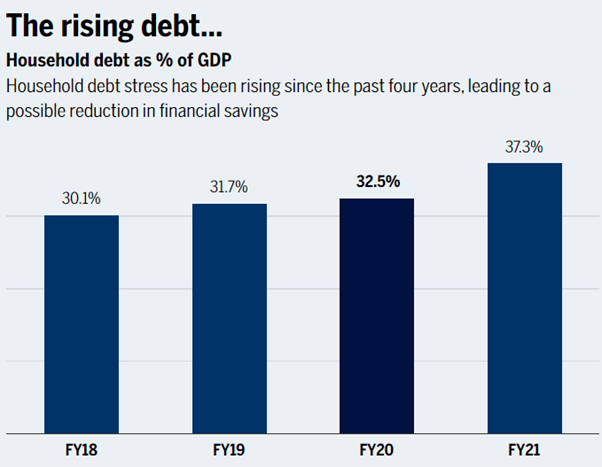

The Household Debt as a % of GDP is not all that bad. However, it is rising.

India’s rising Household Debt as a % of GDP

Data Source: CEIC, SBI Research, Bloomberg, FRBNY