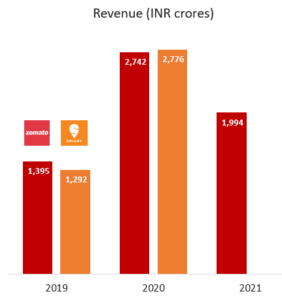

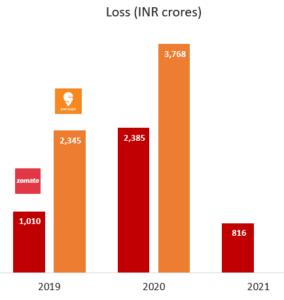

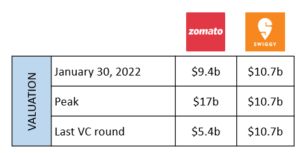

Zomato and Swiggy provide a very interesting opportunity to compare market valuations of two very similar business of the same size.

Swiggy, a private company recently achieved an eye watering valuation of $10.7b. Like any private company, its valuation has seen smooth upticks with each round. On the other hand, Zomato [NSE : ZOMATO] is subject to the vagaries of the listed markets.

Table 1

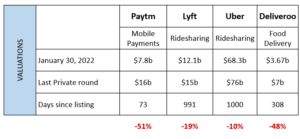

As startups turn into Unicorns and raise a Round H, I, J and so on….they rely increasingly on IPOs to give their final round(s) investors a return on their investment. The potential problem late stage investors face is that their paper profits remain high until their investment is tested in the listed markets.

Table 2: The public fate of few Unicorn Startups across the globe

The VC to Listing journey of large startups is beginning to resemble a popular kid’s party game

Imagine a unidirectional game of Pass the Parcel being played by venture investors where the size of the parcel size gets larger (the soaring valuation in each round) as its passed along. The package must finally reach the listed markets where it may or may not get eliminated. A failed/ subpar listing will lead to losses for the investors of the latter rounds.

The recent bashing of startup IPOs globally once again opens the door to the age old question – what actually is a fair private market valuation? What’s the logic? Is it reliable?

One thing is becoming increasingly clear – listed markets do not have an appetite for companies which themselves cannot predict when they turn profitable. Listed markets may not be as thrilled about metrics such as more subscribers/ users when it comes at the cost of larger losses as is visible in the case of the companies mentioned in Table 2.

However, some loss making entities may fair alright – ones which have unique tech or a “MOAT”.

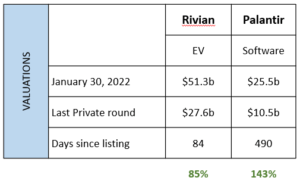

Table 3: Take a look at Rivian and Palantir

Rivian has slipped 45% from its IPO price after debuting at a 50% premium.

Rivian has slipped 45% from its IPO price after debuting at a 50% premium.

Data Source: Marketwatch, Zomato, Inc42 | 2021 figures not released by Swiggy.